Editorial--The On Liberty Curve

The recent news that the deficit is smaller than expected, provides evidence that Bush's tax cuts did indeed increase revenue to the government, as tax cuts did for Reagan and Kennedy before him. Here is an excellent post that covers the news nicely. This provides more evidence that economist Arthur Laffer was correct when he introduced his much maligned Laffer Curve.

The recent news that the deficit is smaller than expected, provides evidence that Bush's tax cuts did indeed increase revenue to the government, as tax cuts did for Reagan and Kennedy before him. Here is an excellent post that covers the news nicely. This provides more evidence that economist Arthur Laffer was correct when he introduced his much maligned Laffer Curve.The Laffer Curve

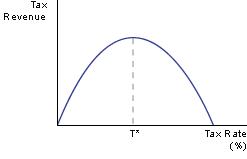

Critics of the curve ridiculed the theory behind the curve by misrepresenting it. No one ever said all tax cuts of any size will always increase revenue, if they did it wouldn't be a curve, it would be a line rising to the left. The concept is quite simple, if the government sets a tax rate at zero, the government will raise no revenue. If the government sets a tax rate at 100%, human nature being what it is, no revenue will be raised, because no one is going to engage in any economic activity if the government is going to take all the money. Therefore, if you track revenue from 0% - 100% taxation, you will get a curve, with T being the point of maximum revenue. If tax rates are set higher or to the right of T, then a tax cut will indeed increase revenue.

The On Liberty Curve

Using the same theory, we here at the Institute developed The On Liberty Curve a number of years ago after hearing William F. Buckley propose something similar. The premise is similar to the Laffer Curve.

If the government sets the tax rate at 0%, they raise no revenue and we have chaos, given enough time we have no liberty either. If the government sets the tax rate at 100%, we are essentially slaves to the state, and we have no liberty. Therefore it stand to reason that we have a curve, just like the Laffer curve where T represents maximum liberty. We here at the Institute theorize that the maximum liberty T is somewhere to the left of the T that represents maximum revenue.

It is our view, here at the Institute, that libertarians and small government conservatives should concern themselves with setting tax rates at the point of maximum liberty and not maximum revenue.

We would think that Democrats who prefer a more energetic state would concern themselves with finding the point of maximum revenue based on the Laffer Curve. They don't. We suspect they don't because of the power over the electorate that comes from taxation, revenue raised is of less concern.

We would also think that deficit hawk conservatives would be particularly interested in finding point T on the Laffer Curve. What few there are in Washington don't seem to be. They will only go along with tax cuts when they are promised the beads and trinkets of future spending cuts that for some reason never materialize.

This concludes an editorial from the staff of The Ebb & Flow Institute.

<< Home